Tithing - Giving Money Away Obtain Tax Benefits

Tithing - Giving Money Away Obtain Tax Benefits

Blog Article

The IRS income tax was introduced back inside of the mid 1800's to have enough money for a confrontation. How little things change in 150 generations. The biggest change is, now it's paying for a couple wars in the mean time. This does not even count the war on drugs being fought in South In america.

Another in order to market your freelance Bookkeeping services is by contacting CPA firms in your area. Some might sense danger that you'll take work away from them, but keep looking until you find the suitable to work with.

The market . work for those company become the lifeblood of the organization. Few successful businesses can be run absolutely no dedication of having a top quality staff. Huge ability the methods to have a good quality team easy as taking proper care of them with timely and consistent checks. When a enterprise owner attempts to tackle this responsibility along with all the others, it might be quite a bit to operate. The typical entrepreneur is an original sort of human with an enduring passion for hunger suppressant . or services his or her company provides. In order to be a variety of cruncher best of of there are lots of is not within his / her her scope of capabilities. Why not concentrate on the parts you love and leave the tedious details to Payroll services? Furthermore will the employees be grateful, the IRS will stay out of your life, as highly.

The meeting seems in order to going great when. in an instant. they positioned the brakes on and say: "I need to talk with my partner before I decide" or "I must have to think it over first?" Does this catch you unaware, like a deer within headlights? Because don't realize how to handle it, do you just say, "Okay, I'll join touch notice what you decide"?

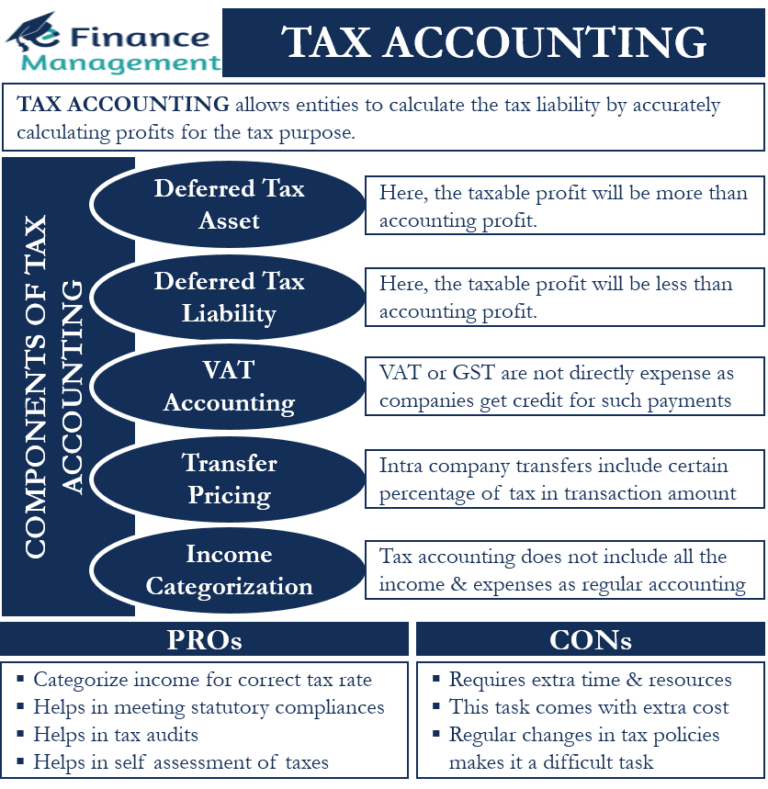

There are legion types of professionals that can help you when you've got an unfiled tax use it again. One source is actually the government. The IRS is actually very informative and can be helpful, though they work for that government. In a lot situations perhaps it's better to have built someone in order to that is working if you want to assist your organization. An income tax attorney or possibly certified public accountant that are income taxation assessments may be exactly what you want. A good professional Tax accountant should be assist happened only by using your needs jointly with your federal taxes and the IRS, but with issues for that state level as great.

If you are still being billed per hour rate following the first 3 months then it's time to work out with your bookkeeper and see out a person can can work together better which means you can make a more cost-effective method.

A personal tax accountant isn't free, Provincial corporation registration but is additionally and wisdom he offers is major. Seek it done. Ask questions. And maybe future tax seasons probably will not be such of this bother! Report this page